Service Announcement

We have been made aware of recent fraudulent calls made to HomeStreet Bank clients that appear to come from a HomeStreet phone number. HomeStreet Bank will never call and ask for your log in information to online banking. This includes your password, phone numbers, one time security codes or tokens. If you do receive a call or text from someone claiming to be with HomeStreet Bank and you are asked for this information, please hang up and call Customer Service at 1-800-719-8080.

Routing Number: 325084426 800.719.8080

Consumer Account FAQs

Welcome to HomeStreet Bank

Below are some of the frequently asked questions concerning the transition of your account(s) to HomeStreet Bank.

NOTE: You may receive separate, additional notices from HomeStreet Bank that provide more detailed information on upcoming account changes. Please take a moment to review this information and, if necessary, act upon these changes per the instructions provided.

General Information

When will my Union Bank account(s) transition to HomeStreet Bank?

Your Union Bank account(s) will automatically convert to HomeStreet Bank Monday, May 22, 2023

Account Information

What are the account terms and conditions associated with my new account?

For account information, please refer to the Change in Terms booklet for personal accounts that was mailed to you prior to this transition. Generally, for personal accounts, the

current names, features, and benefits of your former Union Bank deposit accounts will be converted to a similar HomeStreet Bank deposit account.

Will the service charges associated with my account change?

For personal

accounts, your service charges may change, depending on your account. Please review the Account Product Changes as well as the Comparison of General Fees in the Change in Terms booklet for personal accounts.

Account Numbers

Will my account number change?

Unless we notified you otherwise, your account number will not change.

Will the routing number change?

Yes, HomeStreet Bank's routing number is 325084426.

Will I need to set up my direct deposits, ACH transactions, automatic payments, and transfers again when my account(s) converts to HomeStreet Bank?

Yes. To ensure there is no disruption to any of your automatic transfers/payments, direct deposits,

or ACH transactions, we recommend you contact these companies to provide HomeStreet Bank's routing number 325084426 and to verify your new information is updated on their systems.

If automatic payments are set up via your Union Bank debit card,

those will need to be updated with your new HomeStreet Bank debit card information.

Account History

Will I be able to access my Union Bank account transaction history online?

Access to Union Bank Online Banking will be unavailable beginning at 8:00 PM on Friday, May 19, 2023. All account history will need to be downloaded before this date.

Your Union Bank account transaction history will not available through HomeStreet Bank Online Banking.

To request paper copies of your former Union Bank account transaction history, contact your local HomeStreet Bank branch or our

Customer Service Center at 800-719-8080.

Note: Retrieving this information could take up to seven business days.

Will I be able to access my Union Bank account statements online?

Access to Union Bank Online Banking will be unavailable beginning at 8:00 PM on Friday, May 19, 2023. All account statements will need to be downloaded before this

date. Your Union Bank account statements and documents will not available through HomeStreet Bank Online Banking.

To request paper copies of your former Union Bank account historical statements, contact your local HomeStreet Bank

branch or our Customer Service Center at 800-719-8080.

Note: Retrieving this information could take up to seven business days.

Checks

Can I continue to use my former Union Bank account checks?

Please discontinue use of all checks associated with Union Bank on Friday, May 19, 2023, and contact your local HomeStreet Bank branch to order checks.

Branch Information

Will branch phone numbers change?

Big Bear, Hesperia, and Yucca Valley branch phone numbers will remain the same.

Will branch hours and locations change?

Big Bear, Hesperia, and Yucca Valley branch hours and locations

will remain the same.

Statements

When will I receive statements for my checking, savings and money market accounts?

For personal accounts, your final statement from Union Bank will be a paper statement mailed to you.

Personal checking account statements are issued

on the 5th of the month.

Personal money market account statements are issued on the 10th of the month.

Savings account statements are issued quarterly unless the account has electronic transactions, in which case the statement

is issued at month-end.

Wire Transfers

How do I send or receive a wire transfer?

To initiate outgoing wires via online banking, phone, fax, or email, you will need to sign a new wire transfer agreement. Wire transfer agreements are not required for wire transfers processed in the

branch.

Incoming domestic wires should be sent to your account number and HomeStreet Bank's routing number, 325084426.

Incoming international wires should be sent to your account number and HomeStreet Bank's SWIFT code, HOMSUS6S.

ATM & Debit Cards

Can I continue to use my existing Union Bank ATM and/or debit card?

Your Union Bank ATM or debit card will be deactivated as of 8:00 PM on Friday, May 19, 2023, and new transactions will no longer be accepted. We recommend that

you destroy you Union Bank card(s) after that time.

Your current Union Bank ATM and/or debit card will be replaced with new HomeStreet Bank ATM and/or Visa® debit cards. Your new cards will not arrive until after May 26. We encourage

you to plan accordingly by using credit card, cash or an alternative account for payment of items until your new card arrives.

What should I do if I haven't received my new HomeStreet Bank ATM and/or debit card?

If you have not received your new HomeStreet ATM and/or debit card by May 26, please visit your local HomeStreet Bank branch or call us at 800-719-8080

option *. Please remember, you'll need to activate your new HomeStreet ATM and/or debit card before your first use.

What should I do if I haven't received the PIN for my new HomeStreet Bank ATM and/or debit card?

If you have not received the PIN for your new HomeStreet ATM and/or debit card by May 26, please visit your local HomeStreet Bank branch

or call us at 800-719-8080 option *.

Will I need to update the card information in my Mobile Wallet?

Yes. After you receive and activate your new HomeStreet Bank debit card, you will need to add it to your mobile wallet.

Credit Card

Will my Union Bank credit card still work?

Union Bank branded credit cards are not transferring to HomeStreet Bank and will remain with Union Bank

Telephone Banking

Can I access my account by phone?

For personal accounts, you can use HomeStreet Bank's telephone banking system at 800-719-8080 option 1 to assist in most of your banking needs 24 hours a day, 7 days a week. You will need your

account number and PIN to access telephone banking. For your security, please visit your local HomeStreet Bank branch, call us at 800-719-8080 option * or refer to the Consumer Account Access Information packet for instructions on how to

access telephone banking.

Online Banking

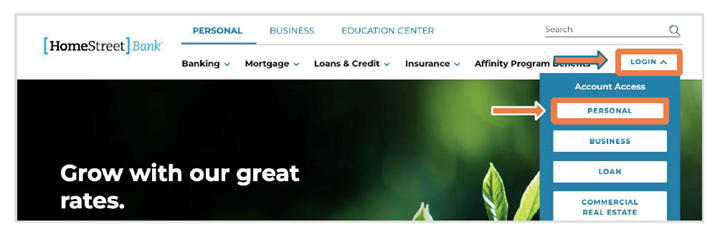

How do I access my account(s) in HomeStreet Bank's Online Banking? For personal accounts, HomeStreet Bank’s Online Banking services will be available on Monday, May 22, 2023 at 9:00 AM. Go to homestreet.com, at the top right-hand corner click “LOGIN”, then select “PERSONAL” from the drop-down list. Follow the prompts and enter the required information.

For your security, please visit your local HomeStreet Bank branch, call us at 800-719-8080 option * or refer to the Consumer Account Access Information packet for your new User ID and new password.

I set up nicknames for my accounts. Will they transfer over?

No. Unfortunately, we are unable to convert that information and you will need to set up any account nicknames again.

Will my email and text alerts transfer over?

No. Unfortunately, we are unable to convert that information and you will need to set up your alert preferences again.

Online Account-to-Account Transfers

Will my Union Bank internal online account transfers be migrated to my HomeStreet Bank Online Banking profile?

No. Internal account transfers (one-time and recurring) with a scheduled delivery date for after May 19, 2023 will need to

be re-entered by you.

Online Bill Payment

Will my Union Bank online bill payments be migrated to my HomeStreet Bank Online Banking profile?

No. Bill payments (one-time and recurring) with a scheduled delivery date for after May 19, 2023 need to be re-entered by you.

You

also need to set-up eBills (bills sent electronically from you bill payees into your Online Bill Payment account) and designate additional funding accounts.

Bill payments scheduled by 6PM will process that same business day. Payments are

sent on the date you schedule them. Funds sent by check are withdrawn on the day the check is presented for payment by the payee. Payments made electronically are withdrawn on the day you request the payment be sent.

The maximum dollar

limit for each Bill Pay payee is $9,999.99 per day. The maximum dollar limit for all Bill Pay transactions is $20,000.00 per day. These limits apply per Online Banking customer profile.

Mobile Banking

How do I access my account(s) in HomeStreet Bank's Mobile Banking?

For personal accounts, before you will be able to access your accounts in the HomeStreet Bank Mobile Banking app, you must successfully log into HomeStreet Bank's

Personal Online Banking from a laptop or desktop at least once and change your password. On or after May 22, 2023, you can download the HomeStreet Bank Mobile Banking app on your device to access your accounts from the App Store® for iPhone®

or Google Play™ for Android™.

On or after, Monday, May 22, 2023 all checks submitted through Mobile Deposit must be properly endorsed by the customer adding the following statement below the signature: “For Mobile

Deposit Only at HomeStreet Bank.” Mobile deposits must be processed by 5PM to be posted the same day.

Zelle ®

Can I use Zelle ® to send or receive money from people I know and trust?

For personal accounts, you will need to enroll in Zelle within HomeStreet Bank Mobile Banking to use the Zelle service.

eStatements

Will my Union Bank account statement delivery preferences be migrated to my HomeStreet Bank Online Banking profile? No, you will need to re-enroll to receive HomeStreet Bank eStatements and discontinue paper statements.

To

enroll, please go to the Accounts tab in Online Banking and select Online Documents. Accept the Disclosure and Agreement and select "Online" delivery method.

Quicken

I use Web Connect and Direct Connect at Union Bank, how do I connect to Quicken at HomeStreet Bank?

Web Connect and Direct Connect users will need to modify their settings to continue to download transactions into Quicken.

If you need assistance, please contact us at 800-719-8080 option *.

Social Security Scams

What should I do if I receive a call from someone claiming to be from Social Security?

We urge you to always be cautious and to avoid providing sensitive information such as your Social Security number or bank account information to unknown

individuals over the phone or internet. Social Security will never call to ask you for your personal or financial information. Always verify the person calling you is legitimate by calling the SSA directly at 1-800-772-1213 to find out if they are

really trying to reach you and why. Do not trust caller ID. Scam calls may show up on caller ID as the Social Security Administration and look like the agency's real number. Hang up and call the SSA directly if you are unsure of the caller. If you've

already provided this information, visit IdentityTheft.gov/SSA to find out what steps you can take to protect your credit and your identity.