Account Transition Update: January 20, 2026

In March, we will be transitioning your account from the current HomeStreet systems to Mechanics Bank. Please continue to visit this site for important updates in the coming weeks to help ensure a smooth transition. In the meantime, please make sure your personal information is up-to-date so we can reach you if needed.

To update your contact info, login to your existing Personal or Business Online Banking account at homestreet.com and update your info by clicking on "Customer Service" and then "Contact Information" OR

- Call us at 800.719.8080 M-F 8am - 5pm (PST) or Sat. 9am - 5 pm (PST) OR

- Stop by your local branch

As of Tuesday, September 2, 2025, HomeStreet is now Mechanics Bank. This merger allows us to deliver even more value to you and serve you in more locations.

Mechanics Bank is an independent, full-service bank based in Walnut Creek, California, with more than $22 billion in assets, and a best-in-class deposit franchise. Managing a transparent and simple balance sheet, Mechanics Bank values core banking and lending principles that have allowed it to withstand challenging times, including the 1906 San Francisco earthquake and fire, the Great Depression, and World Wars I and II.

A letter from Mechanics Bank President and CEO, C.J. Johnson

Welcome, to Mechanics Bank! Our merger with HomeStreet Bank has united two historic West Coast companies with strong values and dedicated employees who are passionate about serving you and our local communities.

Together, we will provide

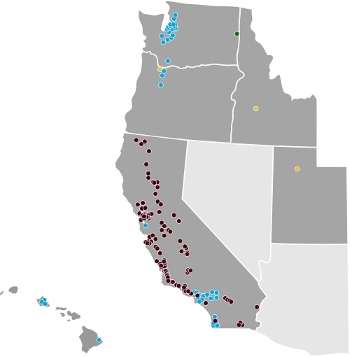

you an even broader, more convenient network of 166 branches throughout California, the Pacific Northwest and Hawaii - and you'll still be greeted by the same familiar faces at the same convenient locations.

You can also expect Mechanics

Bank to practice our time-tested, common-sense banking principles that have made us strong, safe and resilient since 1905.

In the coming weeks and months, we'll provide updates here about any changes you may experience with your accounts.

In the meantime, please do not hesitate to contact us if you have any questions. We're here to help.

Thank you for your continued trust in us. We look forward to a bright future together and to serving your financial needs.

Sincerely,

C.J. Johnson

President and CEO

Here's what to know now

Bank as usual

Your day-to-day banking remains unchanged for now as we work to integrate our organizations. There are no changes to your accounts or services. You’ll continue to be greeted by the same familiar faces at the same convenient locations.Accounts transition early next year

In the first quarter of 2026, we expect to begin integrating our two banking systems, which may result in changes to your account(s) and our current products and service offerings. We’re confident that any changes will provide access to even more banking and financial solutions to help you achieve your goals, as well as enhance your online and mobile banking experience.FDIC insurance

Now that our organizations are combined, it’s important to understand how your accounts are protected under FDIC insurance. Learn more here.Enhanced resources and convenience

The merger brings a broader, more convenient network of banking centers — 166 in all — throughout California, Washington, Oregon, and Hawaii. Enjoy this immediate benefit—you can now use your HomeStreet debit card to make cash withdrawals at any Mechanics Bank banking center ATM with no fees.*Have questions?

Please see our FAQs below and our updated privacy notice. You can also reach us at 1.800.719.8080. We’re here to help you 24/7 (except major holidays).Watch for ongoing updates

We’ll keep you informed throughout the transition with timely updates. Please ensure your contact information is up to date with us so you receive all the important communications.Frequently asked questions

Yes. HomeStreet Bank is now Mechanics Bank

No. For the time being, please continue banking with us just like you do today. The full integration of our products and services are not expected until the first quarter of 2026.

• Use your current HomeStreet Bank account number(s) and loan number(s)

• Use your current HomeStreet Bank routing/transit number for all transactions

• Use your same HomeStreet Bank checks, ATM/Debit Card and Visa® credit cards

• Use your usual online banking and bill payment service at HomeStreet.com until further notice

• Use your same HomeStreet mobile banking apps until further notice

• Handle all of your transactions as usual (deposits, loan payments, etc.)

• Contact your local banker or relationship manager with any questions

Yes. FDIC insurance remains automatic and free for you as a customer. Standard FDIC insurance coverage is $250,000 per depositor, per insured bank, for each account ownership category.

As of September 2, 2025, HomeStreet Bank and Mechanics Bank are considered insured by the same depository institution (Mechanics Bank). Basic FDIC insurance coverage for deposit accounts (checking, savings, money market, and certificates of deposit [CDs]) is $250,000. If you have deposits at both banks at this time, your deposits will remain insured separately for at least six months from this date and possibly longer for CDs. This grace period gives you the opportunity to restructure your accounts, if necessary. You may also qualify for more than $250,000 in FDIC insurance coverage if you own deposit accounts in different ownership categories. Your local branch staff will be able to discuss account options and additional solutions with you to help optimize your FDIC insurance. If you have questions about FDIC insurance or would like to calculate coverage for your individual situation, please visit www.fdic.gov/deposit/deposits

• Use your current HomeStreet Bank account number(s) and loan number(s)

• Use your current HomeStreet Bank routing/transit number for all transactions

• Use your same HomeStreet Bank checks, ATM/Debit Card and Visa® credit cards

• Use your usual online banking and bill payment service at HomeStreet.com until further notice

• Use your same HomeStreet mobile banking apps until further notice

• Handle all of your transactions as usual (deposits, loan payments, etc.)

• Contact your local banker or relationship manager with any questions

The security of your personal information is our priority and we continuously work to protect your information and personal data. We use state-of-the-art security equipment and rigorous security protocols for your protection.

Please be aware that we will never call, text, or email you to ask for your password, personal information, or PIN details. If you receive a suspicious call, hang up immediately and call Customer Service at 1-800-719-8080.

Connect with us

We're here for you—every step of the way. If you have questions, concerns, or just want to talk through what this merger means for you please don't hesitate to reach out.

Find Us

Call us at 800.719.8080

Additional Resources

Check back frequently for more information and resources to help you navigate this transition.